The United Arab Emirates (UAE) is leading the way in digital transformation, particularly in the field of taxation and electronic invoicing. To streamline compliance, improve transparency, and promote international trade, the UAE government has introduced the Peppol Continuous Transaction Control (CTC) model as part of its national e-Billing system. This move represents a major step toward aligning with global standards and enhancing business efficiency.

In this blog, we explore what the Peppol CTC model means, how it integrates into the UAE’s e-invoicing system, and the advantages it offers for companies operating in the region.

What is the Peppol Network?

PEPPOL stands for Pan-European Public Procurement Online. It is a global e-invoicing network that enables businesses and governments to securely and efficiently exchange electronic documents such as invoices and orders in a standardized format.

Global Adoption of Peppol

Originally initiated by the European Union, Peppol has been adopted by countries across Europe, Asia-Pacific, and the Middle East. The UAE’s integration of the Peppol framework into its national e-billing system marks its commitment to transparency, speed, and digital governance.

Key Stakeholders

- OpenPeppol: Maintains the Peppol specifications and framework.

- Access Points (APs): Licensed entities that connect users to the Peppol network.

- Service Providers: Offer system integration, ERP connectivity, and compliance support.

How Peppol Enables Interoperability?

Peppol uses standardized data formats and communication protocols, allowing different software systems, platforms, and countries to exchange invoices easily. This results in faster processing, reduced manual errors, and better compliance.

What is an E-Invoicing Framework?

E-invoicing involves issuing, receiving, and processing invoices digitally, Only structured invoice formats (machine-readable, e.g. XML / PINT AE) can be recognized as eInvoices. Unstructured formats such as PDFs, scanned images, Word docs, or emailed attachments do not qualify as valid eInvoices under the UAE eInvoicing regime.

Types of E-Invoicing Frameworks

E-invoicing frameworks can be broadly categorized into two types based on their architecture and control mechanisms:

Decentralized Frameworks

Decentralized frameworks, such as the Peppol (Pan-European Public Procurement On-Line) model, offer flexibility and interoperability across borders. In this setup, multiple Accredited Service Providers (ASPs) facilitate the exchange of e-invoices between senders and receivers by following a common set of standards.

Key Examples:

- Peppol Four-Corner Model

- Peppol CTC Model (also known as the Five-Corner Model)

Benefits:

Supports cross-border and multi-vendor interoperability

Reduces dependency on a single government platform

Encourages innovation and scalable solutions

Centralized Frameworks

Centralized frameworks rely on a single national platform, where all e-invoices are transmitted and validated by the government authority before being forwarded to the receiver. This approach offers greater control and oversight for tax authorities but can be less flexible for businesses.

Key Examples:

- KSeF in Poland

- SDI in Italy

Benefits:

- Strong compliance enforcement and fraud prevention

- Real-time government monitoring of transactions

- Uniform validation standards

The Peppol CTC Framework: How It Works in UAE

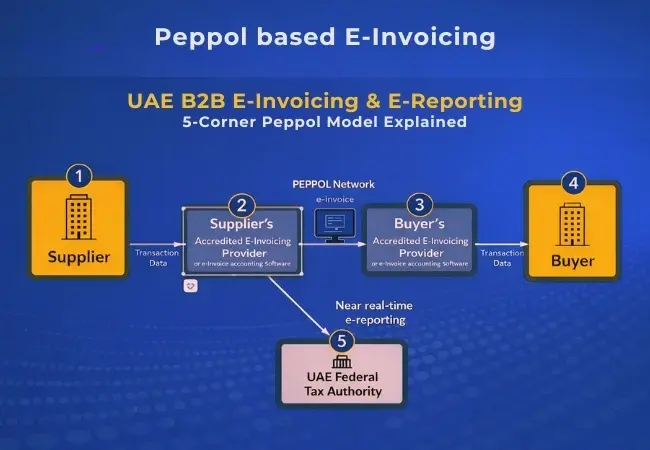

The Peppol CTC model adopts a 5-corner architecture:

| Corner | Process Step | Description |

|---|---|---|

| Supplier (e-Invoicing User) (Corner 1) | Send | The supplier enters invoice data into their business software and initiates the e-invoicing process through their OpenPeppol Accredited Service Provider (ASP). |

| Supplier’s Accredited Service Provider (ASP) (Corner 2) | Validate and Transmit | The sending ASP validates that the invoice meets defined Peppol and UAE standards, then transmits the invoice data to the buyer’s ASP. Invoices can be issued directly for B2B transactions. |

| Confirm ID | The sending ASP verifies the buyer’s details using the OpenPeppol directory before transmitting data, ensuring the correct recipient. | |

| Send Securely | The invoice data is transmitted securely from the supplier’s ASP to the buyer’s ASP using the OpenPeppol network, ensuring confidentiality and integrity. | |

Buyer’s Accredited Service Provider (ASP) (Corner 3) | Collect, Validate and Deliver | The receiving ASP validates the invoice data and delivers it to the buyer’s business system in their preferred format. |

| Buyer (e-Invoicing User) (Corner 4) | Receive | The buyer’s business software automatically receives and populates the invoice data sent by their ASP, completing the e-invoicing process. |

| Ministry of Finance (MoF) & Federal Tax Authority (FTA) (Corner 5) | Collect, Validate and Deliver | The receiving access point (ASP) sends validated invoice data to the Central Data Platform, where it undergoes tax data verification and compliance checks. |

Collect, Process and Store | The Central Data Platform processes and stores all invoice data received from ASPs at Corners 2 and 3 for regulatory, audit, and compliance purposes. |

Secure & Real-Time Data Exchange

- Invoices are transmitted digitally through ASPs and undergo schema / business-rule validation before reporting to the Federal Tax Authority (FTA). The FTA processes the submitted Tax Data Documents and issues status messages (MLS) back to ASPs.

- Transactions are fully traceable and auditable.

- Communication is encrypted, enhancing data privacy and security.

Benefits of the Peppol CTC Model in the UAE

Business Advantages

- Global Interoperability: Integrates with international partners and platforms.

- FTA Compliance: Real-time validation reduces risk of penalties.

- Efficiency: Automates invoicing and improves internal workflows.

- Audit-Ready: Ensures traceability and full transparency.

- Cost-Effective: Reduces administrative and operational costs.

Industry-Specific Gains

- E-commerce: The system’s rapid validation via ASPs and status messaging ensures faster detection of errors and improves VAT compliance

- Logistics: Simplified customs and billing.

- Retail & Wholesale: Streamlined B2B processes.

- Manufacturing: Better cash flow forecasting and cost control.

How It Aligns with UAE’s E-Invoicing Vision?

The Peppol CTC model supports the UAE's goals to:

- Modernize taxation and accounting processes

- Enable cross-border trade compliance

- real-time visibility into economic activity

- Combat VAT fraud with automation and traceability

Why Early Adoption Matters

Businesses that adopt the Peppol CTC model early will:

- Avoid last-minute compliance costs

- Integrate systems gradually without disruption

- Enhance supplier and buyer trust

- Gain first-mover advantage in digital transformation

Need Help with E-Invoicing in UAE ? Trust Reyson Badger

At Reyson Badger, we specialize in providing end-to-end support for e-invoicing solutions, Peppol onboarding, and FTA compliance in the UAE.

The Peppol CTC model is more than a regulatory requirement. It’s a strategic business upgrade. As the UAE embraces this new digital invoicing era, companies that proactively align with it will enjoy better efficiency, cost savings, and long-term compliance.

Don't wait. Partner with Reyson Badger to future-proof your business with Peppol-based e-invoicing.

The Federal Tax Authority (FTA) has announced that businesses must complete Corporate Tax registration within 90 days from the Date of Incorporation / MOA.

The Federal Tax Authority (FTA) has announced that businesses must complete Corporate Tax registration within 90 days from the Date of Incorporation / MOA.